Freddie Mac: Majority of Aging Adults Likely to Age in Place

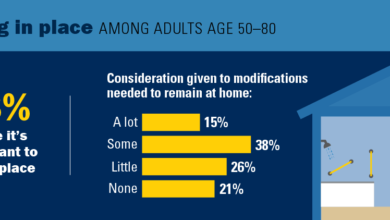

In the past five years, adults in the U.S. age 55 and older made financial gains, and many feel they will have a financially comfortable retirement, according to Freddie Mac surveys. In addition, 66% of them expect to age in place, which may further contribute to the housing supply shortage.

In two surveys, the first in 2016 and again in 2021, Freddie Mac sought to track the attitudes and perceptions of U.S. adults age 55 years and older in several key areas, including mobility in the housing market. When and how this population chooses to sell their homes has implications on housing supply and demand because:

- Baby Boomers hold the majority of real estate wealth in the United States.

- Housing supply in the United States has fallen to record lows in the past two years.

Rather than following the typical pattern of selling later in life, and downsizing or moving to assisted-living facilities, nursing homes or with extended family, our survey results suggest this cohort prefers to age in place — and may be more financially equipped to do so. Aging in Place and Transferring Wealth Compared to the 2016 survey results, U.S. adults age 55 years and older today are doing better financially and more are confident they will have a comfortable retirement.